Traditional health insurance covers your medical bills, but did you know it can also reward you for making wise choices during a hospital stay? When it comes to hospital stays, one of the first decisions you’ll need to make concerns the type of accommodation you prefer. The choice of room can significantly affect both your comfort during the stay and the overall cost of your medical bill.

| Room Type | Description | Privacy Level | Typical Cost |

| Private Room | Only one patient occupies a single room. Different options like deluxe private rooms, presidential suite rooms, etc. | High | High |

| Shared or Semi-Private Room | A room is shared with one or more other patient. These rooms may or may not be AC. | Medium | Moderate |

Understanding Shared Accommodation Cash Benefits

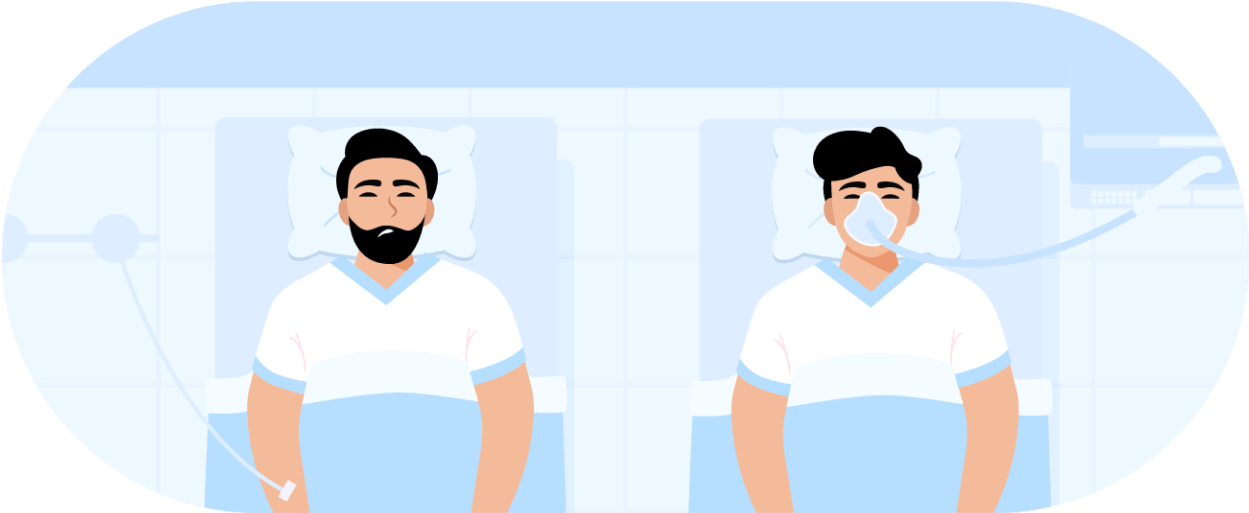

When insured individuals choose a shared room with multiple beds, it helps reduce the overall cost of care, which in turn helps insurance companies manage claims more efficiently. This is why some insurers offer incentives for choosing shared hospital rooms to keep healthcare costs down. These shared accommodation benefits are typically a part of a broader health insurance plan.

Health Insurance Benefits of Shared Accommodation

Sharing a hospital room can translate to significant savings. Not only may it lower your insurance premiums, but it also typically comes with lower daily hospital charges compared to private rooms. This directly reduces your out-of-pocket costs during a hospital stay. However, remember that shared accommodation benefits might have limitations, such as a cap on covered days or restrictions on participating hospitals. Reading your health insurance plan’s terms carefully will ensure you maximise these cost-saving options.

Comparing Health Insurance Plans with Shared Accommodation Benefits

Considering shared accommodation benefits is a smart move when choosing a health insurance plan. Compare plans based on the cash incentives, eligibility requirements, and limitations. Additionally, check the network of hospitals in your plan and their availability of shared rooms. This comprehensive evaluation will ensure you find the plan that best maximises your health insurance benefits.

Use health plan comparison tools to evaluate how different policies handle shared accommodation. Look for user reviews and expert ratings to gauge the effectiveness and reliability of these benefits in real-world scenarios.

Maximising Your Health Insurance Plans with Shared Accommodation

When selecting a health insurance plan with shared room benefits, it’s crucial to consider your personal comfort and financial goals. Start by reviewing shared accommodation in various health insurance plans. Consider options offering substantial shared accommodation cash benefits. Additionally, evaluate the flexibility of each plan— Some might provide cash benefits for shared rooms across a broader range of hospitals within their network, while others might have stricter limitations. This flexibility can significantly impact how often you can leverage these cost savings.

Seek answers to the following questions:

- How much money does the plan offer for choosing a shared room?

- Are there any requirements to qualify for the benefit (e.g., medical condition)?

- Are there limitations on covered days or specific hospitals where shared accommodation is an option?

- Does the plan have a deductible that applies to the cash benefit?

- How many hospitals within the plan’s network offer shared rooms?

- Does the plan allow shared rooms for all hospital stays, or are there exclusions?

It is also crucial to consider your personal needs before opting for a shared room:

- How comfortable are you with sharing a hospital room during your stay?

- Do you have any specific medical needs that necessitate a private room for recovery?

- Would a private room provide you or your loved ones additional peace of mind?

By considering these questions, you can decide whether shared accommodation is a good fit for your needs and budget.

Key Takeaways

Shared accommodation cash benefits are vital in health insurance, helping to manage and reduce medical expenses. Understanding and strategically choosing health insurance plans that offer these benefits can maximise coverage and ensure more sustainable healthcare spending. Utilize platforms like PhonePe to compare and select the best health insurance plans that perfectly balance affordability and comprehensive coverage.

Frequently Asked Questions

How do shared accommodation benefits help reduce healthcare costs?

What factors should I consider before opting for a shared hospital room during my hospital stay?

How can I maximise my health insurance plan with shared accommodation benefits on PhonePe?

What are the limitations of shared accommodation benefits in health insurance plans?

Can I get health insurance plans with shared accommodation benefits on PhonePe?