Critical illnesses and diseases are some things that most people do not worry about on a daily basis. However, with most of us leading a sedentary lifestyle, common lifestyle illnesses like diabetes, hypertension, stress, and mental health have become common causes of concern. Add to this, the ever-rising cost of treatments and medical emergencies and it becomes a financially challenging affair. So, to help you meet such challenges, a Health Insurance policy comes into the picture.

Secure your health

with a comprehensive

Health Insurance

Policy

PhonePe offers Health Insurance Policy online at affordable premiums.

Insure NowHealth

insurance:

the meaning

A Health Insurance policy covers the medical costs that you suffer in a medical contingency. Health Insurance plans cover specific medical expenses and treatments.

For example, say you are hospitalised for an appendectomy. A basic medical insurance plan covers the cost of hospitalisation and appendectomy treatment. So, the medical bills you incur due to hospitalisation and subsequent appendectomy would be paid by the health insurance policy. Moreover, you might incur post hospitalisation medical expenses after being discharged from the hospital, like physiotherapy or diagnostic tests to monitor your recovery. Such expenses are also covered under the Health Insurance plan.

So, a Health Insurance plan covers the cost of medical treatment, whether it is planned or an emergency.

Claiming from your Health Insurance plan

When you incur a claim in your Health Insurance plan, there is a process that you should follow. Here’s a look:

Inform the insurance company

Inform the insurance company immediately if you incur a claim.

Submit a pre-authorisation claim form

If you get hospitalised in a network hospital, your claims would be handled on a cashless basis. You should fill and submit a pre-authorisation claim form for getting approval for cashless claims.

Non-networked hospital

In a non-networked hospital, you need to pay the bills yourself till you are recovered. After that, submit the bills to the insurer. The company would reimburse you for the medical expenses you bore.

Submit all your medical bills

Make sure to submit all your medical bills, reports, and hospital documents to the insurance company to settle your Health Insurance claim.

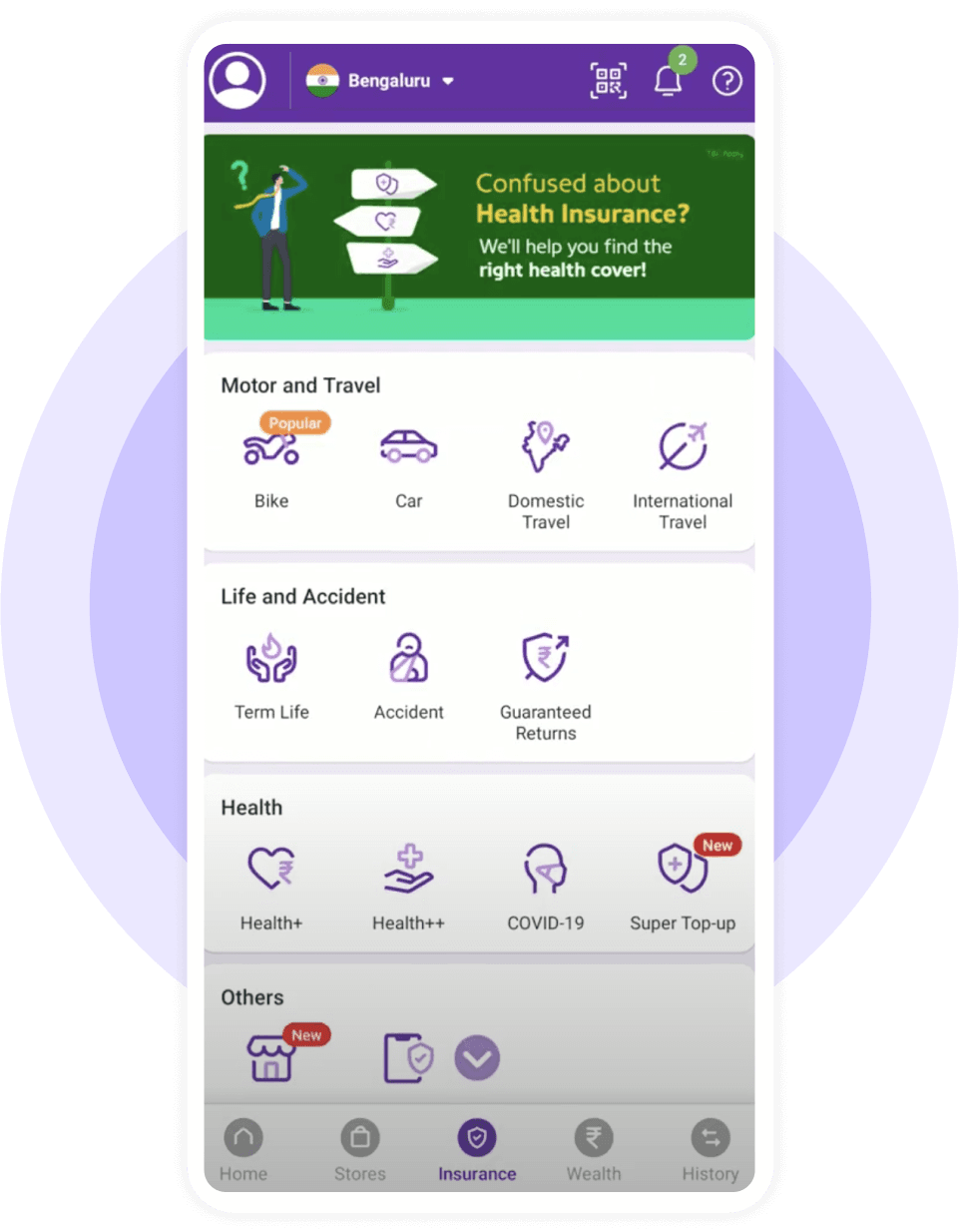

Getting or renewing Health Insurance - the PhonePe way

PhonePe offers you a convenient platform to get or renew your Health Insurance plan. Here are the steps on how you can get a Health Insurance plan from PhonePe:

1. Select 'Health' Insurance

Select the Insurance tab and choose a Health Insurance type

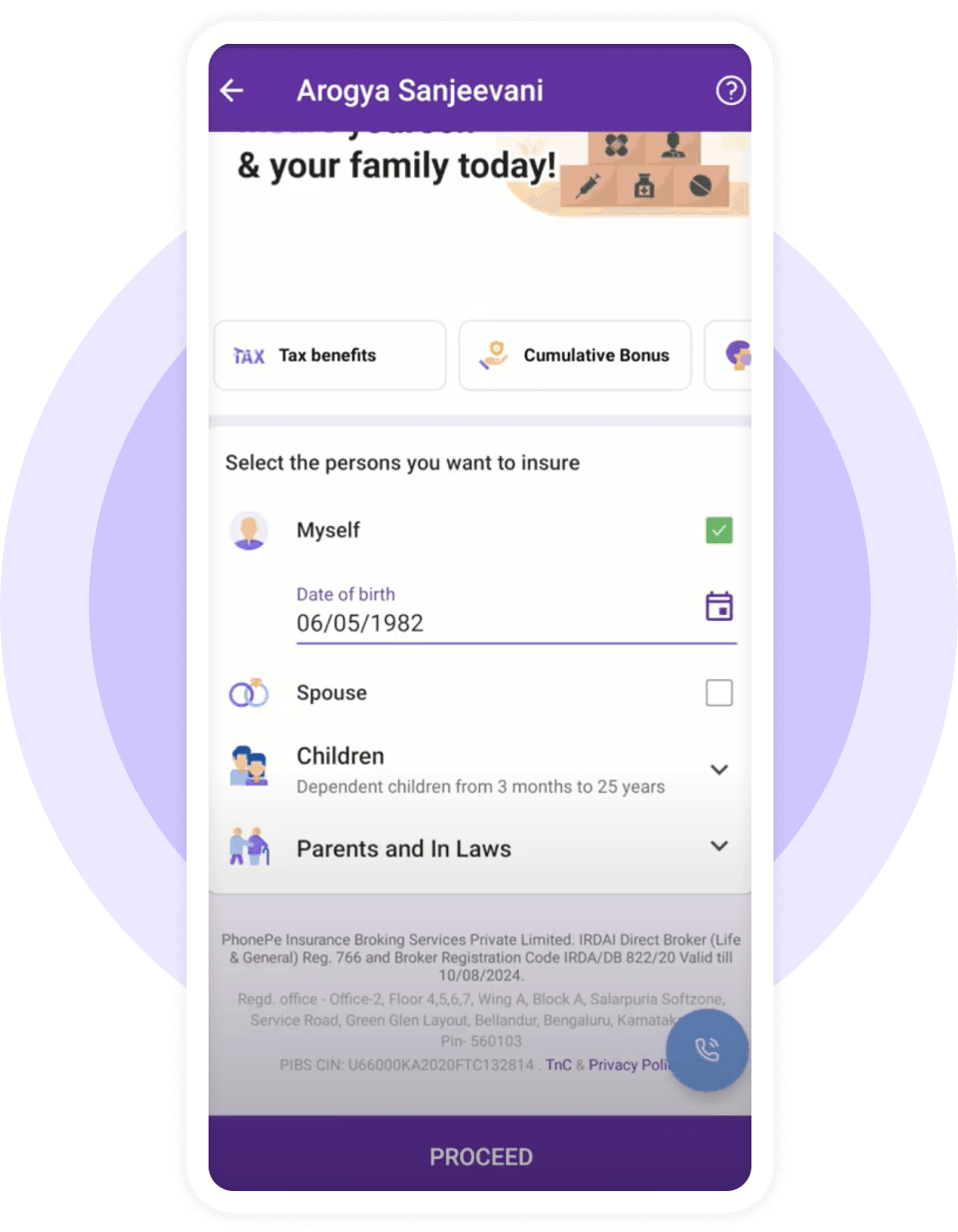

2. Enter Details

Select the persons you wish to insure, cover amount & postal code

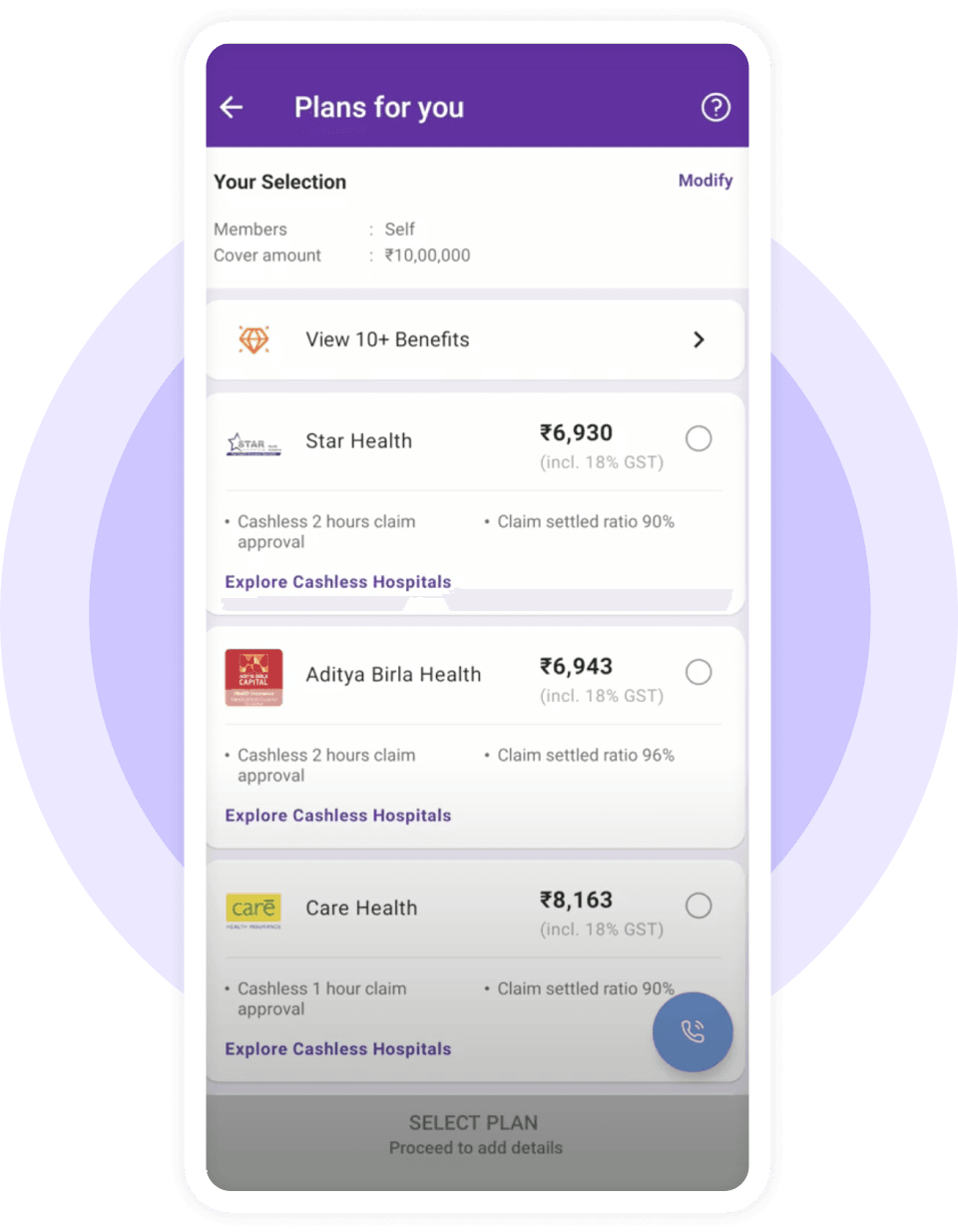

3. Select Plan & Add aditional details

Select the plan & add additional details such as nominee details

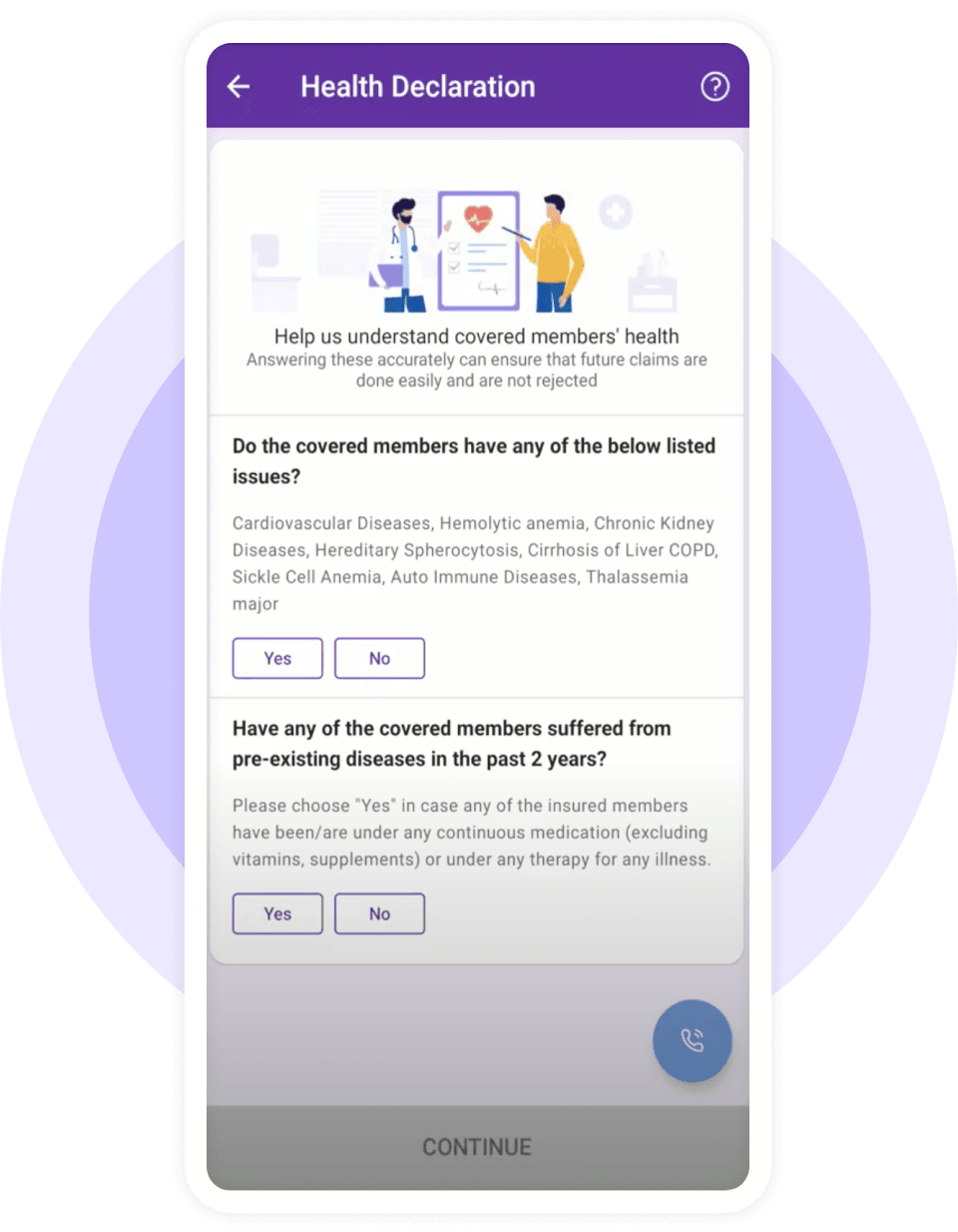

4. Health Declaration

Health Declaration

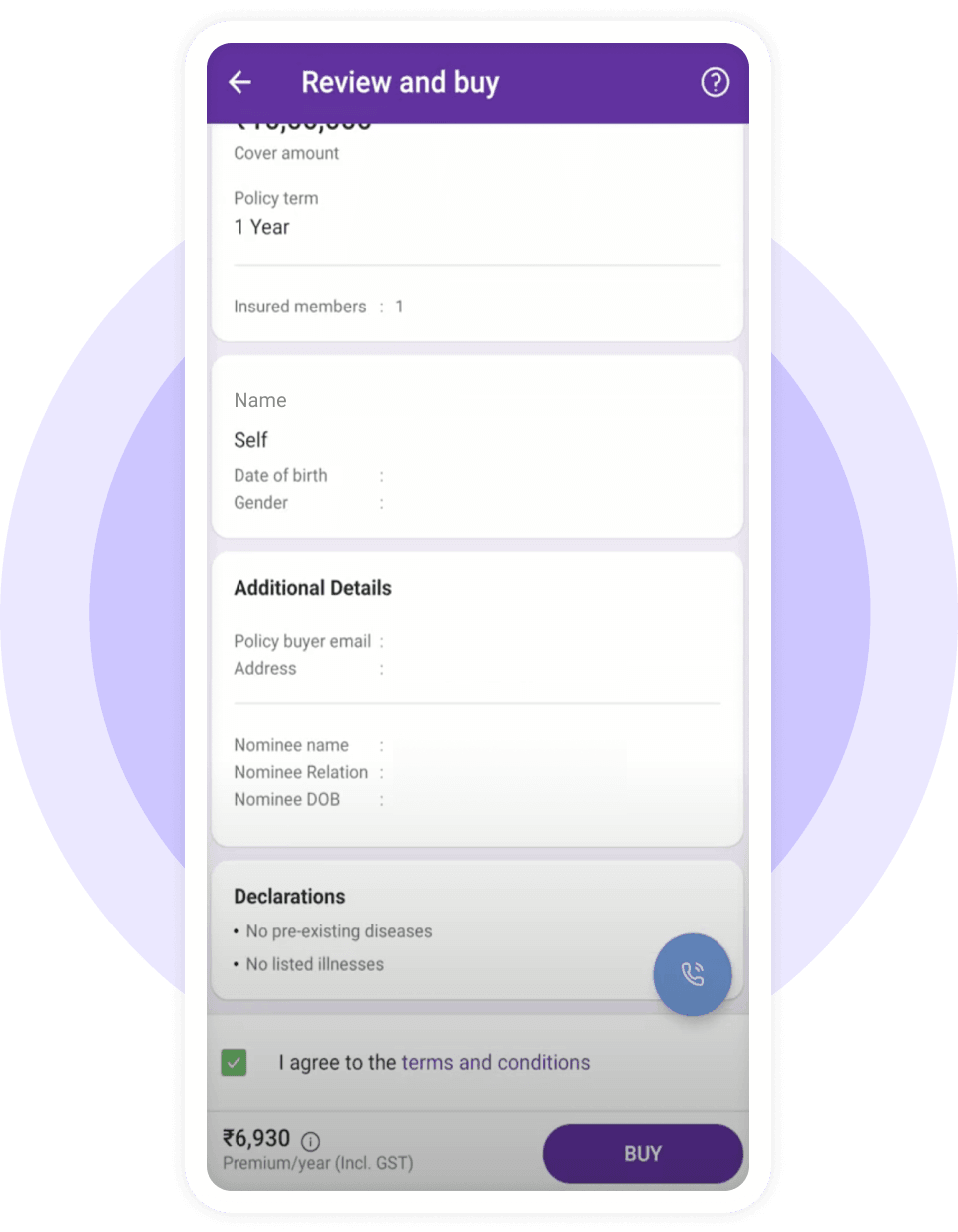

5. Make Payment

Review & Buy

Blogs and Related reading

Got questions?

Read on to find out more!

Does the Health Insurance policy cover COVID-19 treatment?

How to compare Health Insurance plans?

How to calculate Health Insurance premiums?

What are the documents required for Health Insurance?

What is the age criteria to get Health Insurance?

When should I make a Health Insurance claim?

What is the sum insured in Health Insurance Plans?

What are pre-existing diseases & conditions?

How to port a Health Insurance policy?

PhonePe Insurance Broking Services Private Limited. IRDAI Direct Broker (Life & General)

Reg. 766 and Broker Registration Code IRDA/DB 822/20 Valid till 10/08/2027.

Regd. office - Office-2, Floor 4,5,6,7, Wing A, Block A,Salarpuria Softzone, Service Road,

Green Glen Layout, Bellandur, Bengaluru, Karnataka-KA, Pin- 560103

CIN: U66000KA2020FTC132814